February sees first consumer price decline in 13 months

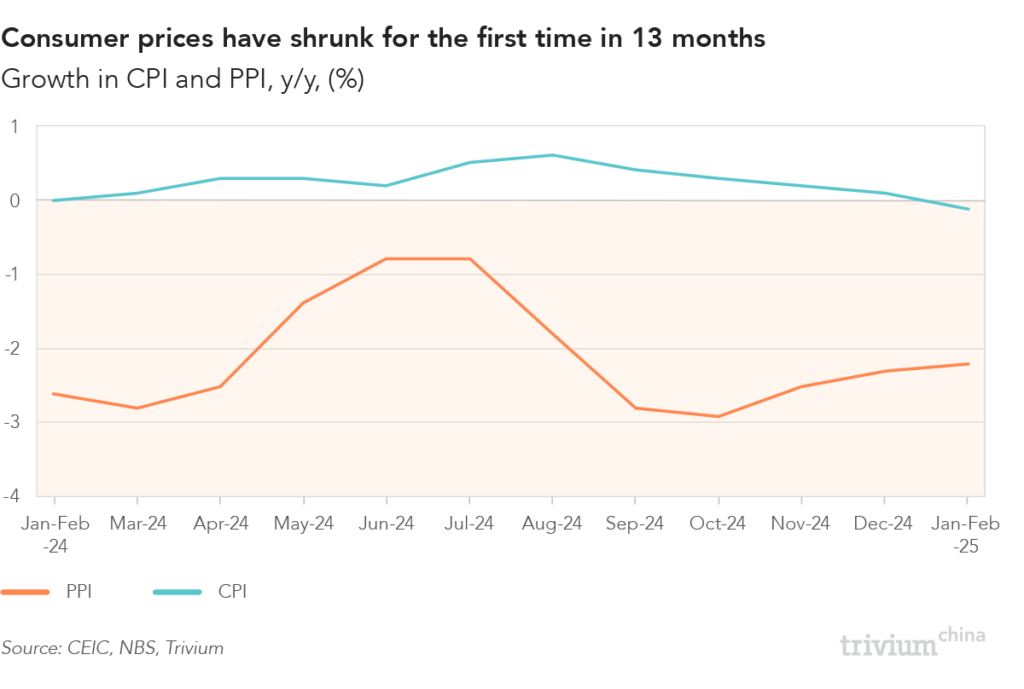

Consumer prices have fallen for the first time in 13 months.

According to data released by the stats bureau (NBS) on Sunday, in February:

- Consumer prices (CPI) fell 0.7% y/y, reversing a 0.5% increase in January

- Producer prices (PPI) fell 2.2% y/y, a slight improvement from the 2.3% drop the previous month

On a month-on-month basis, CPI dropped 0.2%.

No need to panic: The CPI drop was expected due to seasonal fluctuations around the Lunar New Year (LNY) holiday.

- LNY began in January this year, but was entirely in February last year.

- That means this year's February CPI print comes off a high base in both y/y and m/m terms.

In January and February combined – stripping out seasonal distortions – CPI edged down just 0.1% y/y.

- This modest decline was driven by lower consumer goods and food prices, which fell 0.4% and 0.7% y/y, respectively, in the two-month period.

- The price of services grew 0.3% y/y.

Meanwhile, producer prices have now fallen for 29 consecutive months.

Get smart: Deflationary pressures are here to stay, and will continue to haunt the economy throughout 2025.

- The 0.4% y/y drop in consumer prices during the first two months of the year underscores ongoing lackluster consumer spending.

- Meanwhile, PPI deflation shows no sign of slowing and will continue to feed into downstream price pressure, exacerbating CPI deflation.

The upshot: Without a drastic turnaround in price conditions, Beijing will miss its nominal GDP growth target for the third year running.