January consumer prices rise at fastest rate in five months

Consumer price growth picked up somewhat in January.

Per price data released by the stats bureau (NBS) on Sunday:

- January consumer prices (CPI) grew 0.5% y/y, up from 0.1% growth in December.

- Producer prices (PPI) fell 2.3% y/y, the same decline as the previous month.

Two temporary factors provided a short-term boost to January's CPI print.

First, base effects: CPI in January 2024 fell 0.8% y/y, giving a relative boost to this year’s price growth.

Second, seasonal effects: This year, Chinese consumers celebrated the Lunar New Year (LNY) in January, compared to February last year. As a result, LNY-driven price increases benefited from a favorable base comparison.

- Prices for tourism services grew 7.0% y/y.

- Prices for flight tickets grew 8.9% y/y (FT).

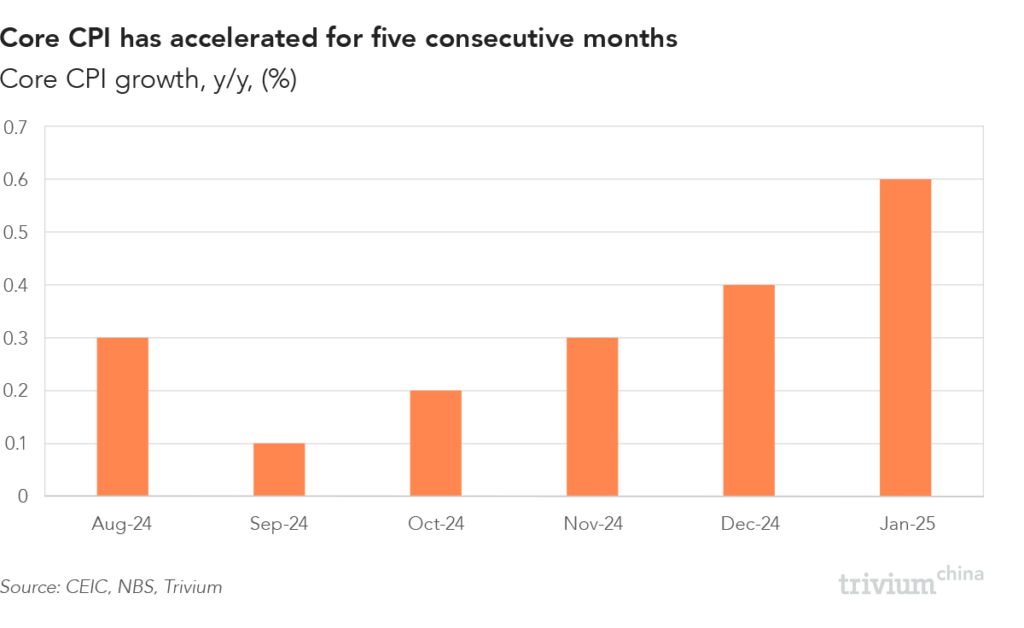

This stood out: Core CPI – which strips out volatile food and energy prices – grew by 0.6% y/y, marking the fourth consecutive month of accelerated price growth.

Factory gate prices, meanwhile, have fallen for 28 consecutive months – and there’s no sign of the deflationary spiral slowing.

- On a m/m basis, PPI fell 0.2%, an acceleration from the 0.1% m/m declines recorded in November and December.

Get smart: After accounting for seasonal and base effects, the January price print reflects a broad continuation of China's deflationary struggles.

Get smarter: But the gradual increase in core CPI is important.

- If core price growth maintains its upward momentum, there's a chance China could break from the downstream deflationary dynamics, shifting consumer expectations and encouraging households to increase spending.