July trade data less than meets the eye

China's headline July trade numbers are impressive, but there's weakness under the surface.

Per data released by the customs bureau (GAC) on Wednesday:

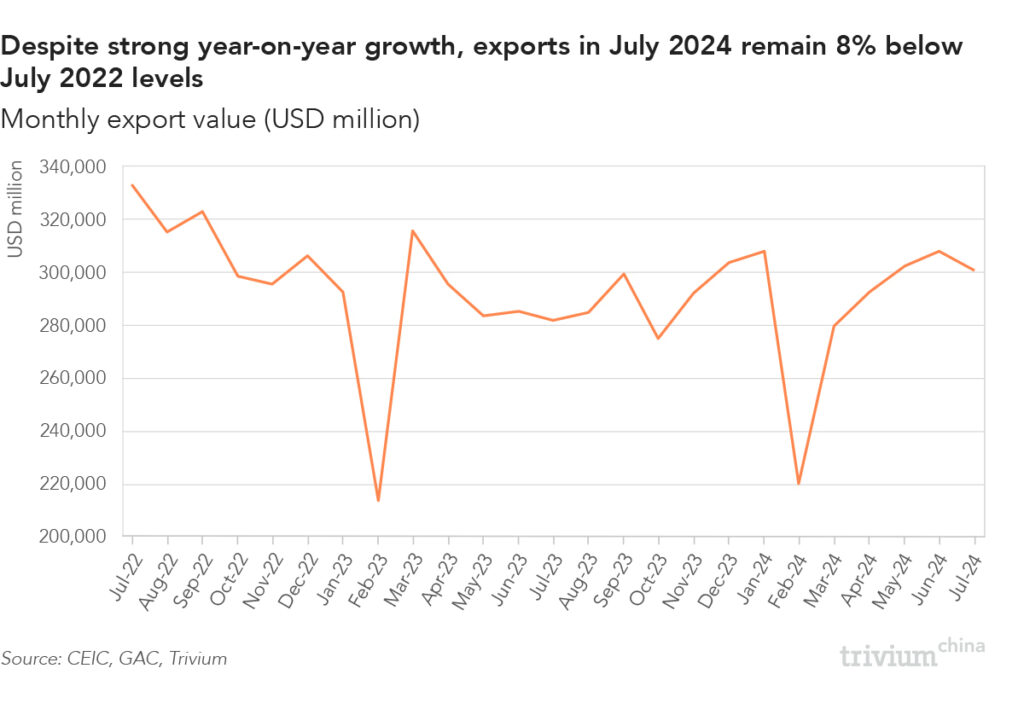

- Exports grew by 7.0% y/y in USD terms last month, down from 8.6% growth in June

- Imports grew by 7.2% y/y, reversing June’s 2.3% decline

- The July trade surplus came in at USD 84.6 billion, up 6.6% y/y

At first glance, this trade print looks pretty good. But digging into the details tells a different story.

First, strong export growth is driven entirely by base effects.

- Exports fell a stonking 14.2% y/y in July 2023, inflating this year’s growth rate.

- Compared to 2022 levels – which strips out base effects – exports last month were down 8.0%.

Second, areas of export strength are only substituting for weak domestic demand.

- In volume terms, exports of cars and home appliances grew a whopping 26.2% and 23.0% y/y, respectively.

ICYDK: The State Council launched a consumer trade-in program in March to stimulate domestic consumption of autos and home appliances.

- The program has fallen flat. Since May – when subsidies first came online – sales of autos and home appliances have fallen by 5.4% and 0.1% y/y, respectively.

Instead, manufacturers are relying on exports to make up for weak domestic demand.

Third, strong import growth isn’t driven by a consumption rebound. Rather, it’s due to industrial activity and manufacturing upgrading.

- Iron ore, copper ore, and coal imports all grew by double digits.

- Imports of semiconductors and high-tech products grew by over 14% and 18%, respectively.

Get smart: Exports were a crucial source of economic growth for China’s economy throughout H1 2024.

- But this month’s export slowdown – combined with growing trade tensions with key trade partners – suggests they will play a smaller role throughout H2.

The bottom line: The July trade data emphasizes the urgency with which Beijing needs to stimulate household consumption.

- So far, policymakers seem short of ideas.