Flip it and reverse it

The script has suddenly flipped for the Chinese currency.

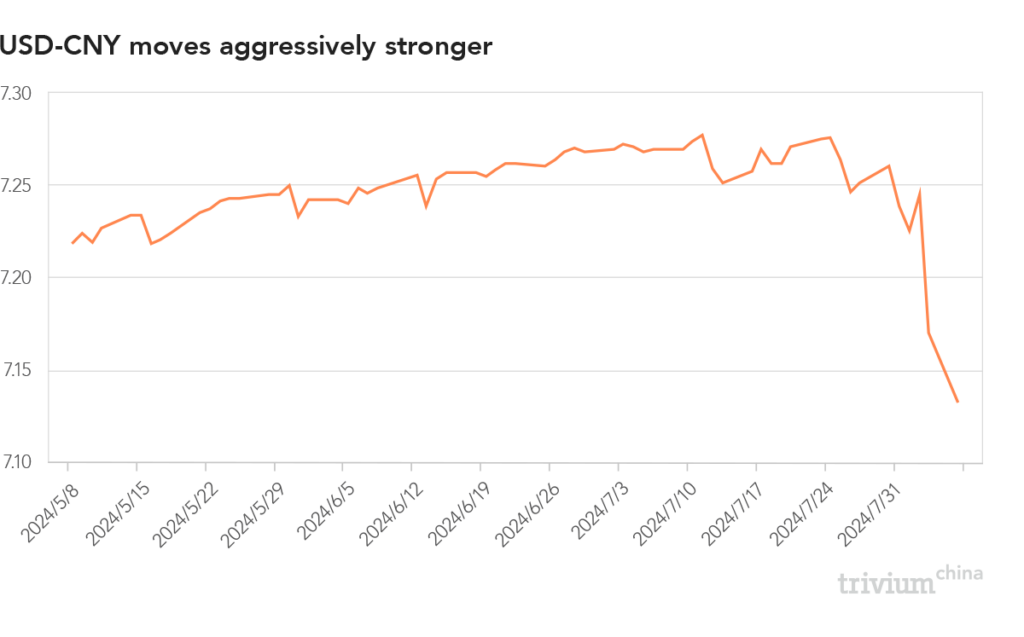

After steadily depreciating against the USD – by 2% since the beginning of 2024 – the CNY has strengthened aggressively by 1.27% in just the past three trading days.

Some context: The yuan’s renewed vigor comes amid wider global market volatility.

- Weak employment data from the US, released Friday, has investors suddenly expecting accelerated interest rate cuts from the Federal Reserve – and soon.

- That’s pushed down expectations about the future strength of the dollar – and led to the unwinding of carry trades predicated on weakness in some Asian currencies, like the Japanese Yen and the CNY.

The upshot: The closing out of carry trades has exacerbated FX moves.

- The CNY and JPY have gained ground to stand at their punchiest rates since January, unwinding eight months of depreciation in a matter of days – as investors have covered previous short positions.

Why it matters: After battling chronic currency weakness since early 2022, the central bank (PBoC) must suddenly contend with a new monetary environment.

- On the positive side, what looks likely to be a period of sustained currency strengthening will give the PBoC more leeway to cut domestic interest rates.

- On the downside, the PBoC will now be looking to temper the speed at which the USD-CNY exchange rate strengthens – in an abrupt reversal of its recent tactics to slow currency weakening.

The bottom line: The PBoC can manage the volatility of a suddenly strengthening CNY, but officials will now look to implement a very different policy framework than that of the past two years.