PBoC to borrow Chinese government bonds

China’s central bank (PBoC) has taken a major step toward realizing its plan to trade government bonds.

The details: On Monday, the PBoC said it would start borrowing Chinese government bonds (CGBs) from primary dealers “in the near future.” It said the measure will:

- “Maintain the sound operation of the bond market”

The PBoC didn’t say what it will do with the bonds, but we expect it will sell them during open market operations (OMOs).

Some context: The PBoC has been working toward trading CGBs to augment its monetary policy tools since Xi Jinping demanded the change in October.

Currently, the PBoC manages short-term liquidity by selling seven-day reverse repos during OMOs and long-term liquidity using the medium-term lending facility (MLF).

- Neither tool has been effective in managing bond yields.

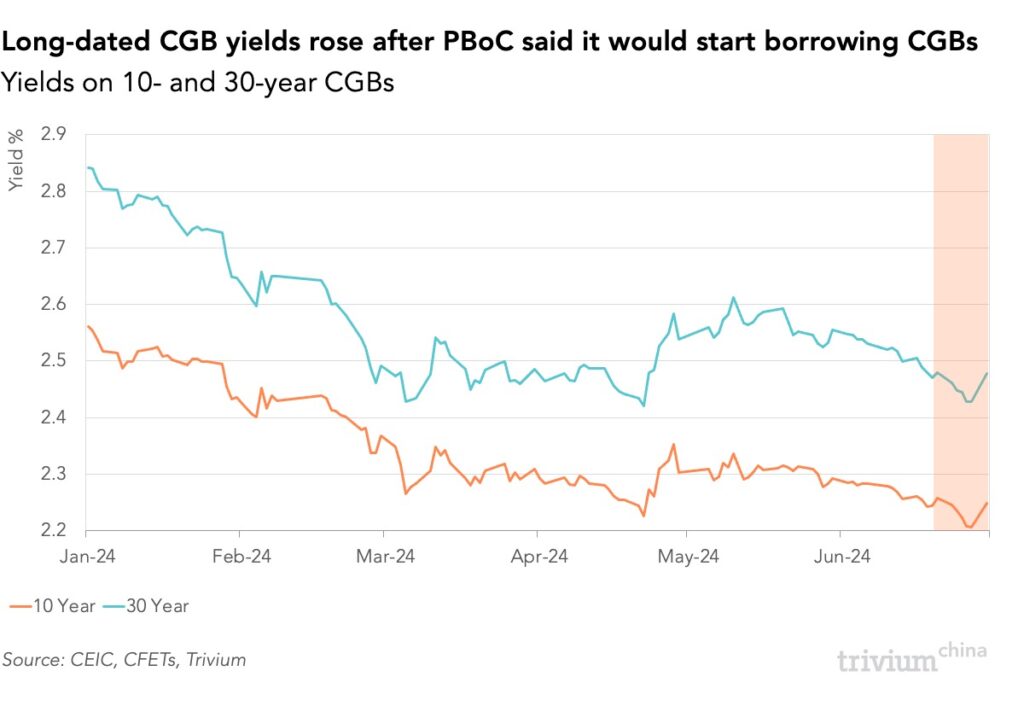

- The PBoC has repeatedly expressed concern about the sharp fall in yields on long-dated CGBs this year.

In selling CGBs, the PBoC can increase supply, driving down prices and boosting yields.

In theory, the PBoC could sell the RMB 1.5 trillion of mostly special treasury bonds (STBs) already on its balance sheet.

- However, borrowing CGBs allows the PBoC to acquire far more bonds than it currently holds, increasing its firepower.

Yields on long-dated CGBs rose following the PBoC’s announcement.

Get smart: The PBoC has repeatedly signaled it intends to overhaul monetary policy to focus more on market rates.

- This is the first move in that direction.