NBS and Caixin PMIs diverge

China's June manufacturing conditions were a mixed bag.

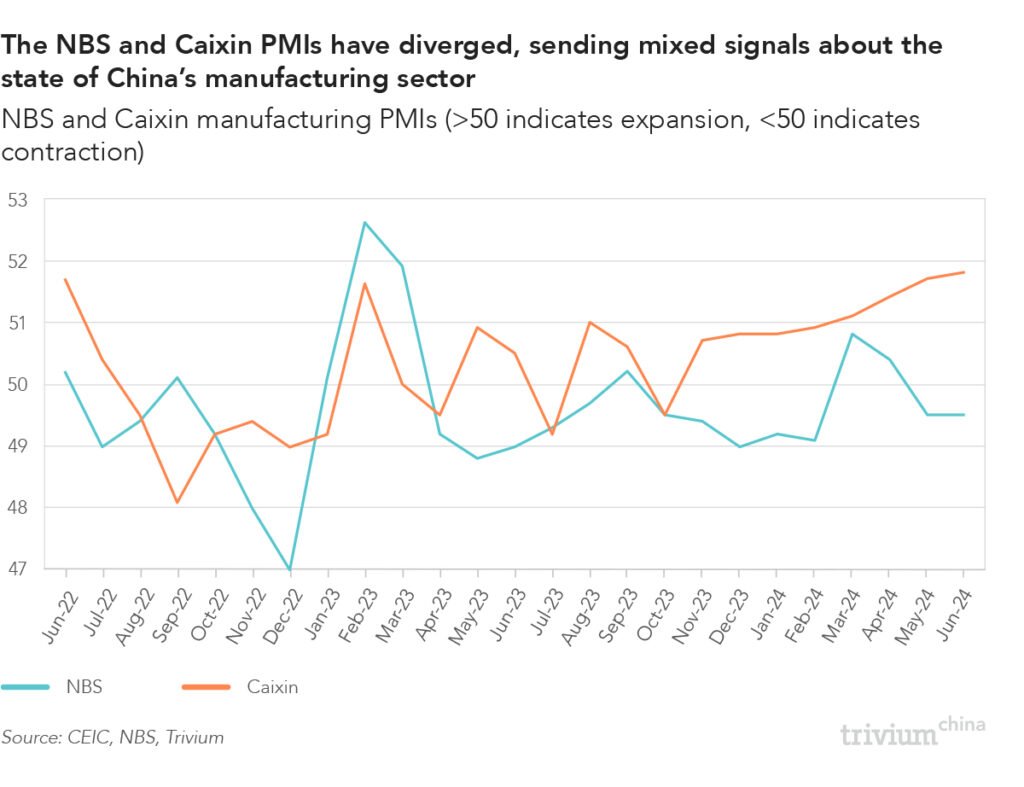

The stats bureau (NBS) and Caixin released their monthly PMI prints on Sunday and Monday, respectively.

A quick refresher: PMIs give a snapshot of business conditions based on survey responses.

- A reading above 50 indicates expansion, and below 50 signals contraction.

The highlights:

- The NBS PMI came in at 49.5 for the month, the same print as May.

- The Caixin PMI was 51.8, the strongest print since May 2021.

There was clearly a big discrepancy between the two PMIs.

- NBS subindices for new orders, exports, and factory gate prices all contracted.

- The same subindices measured under the Caixin PMI all expanded.

One thing both PMIs agreed on: Labor market conditions are still challenging.

- The NBS and Caixin employment subindices contracted for the 16th and 10th consecutive months, respectively.

Get smart: Media outlets attribute the divergence in PMI prints to differing survey samples, with the NBS PMI focused on state-owned enterprises (SOEs) and the Caixin PMI skewed toward private, export-oriented companies.

- However, we’ve looked through the methodologies of both PMIs and found no evidence to support this claim.

- Both the NBS and Caixin PMIs survey private and state-owned manufacturing firms in proportion to their contribution to total GDP. This ensures the survey panel is representative of China’s broader manufacturing sector.

The bottom line: June’s discrepancy in the NBS and Caixin PMI prints is likely down to statistical white noise and month-on-month sampling biases.

- Taken together, the two PMI prints paint a mixed picture of China’s manufacturing sector, which means we’ll reserve judgment until the Q2 econ data drops late next week.