May’s data shows early signs of economic rebalancing

China’s economic supply-demand gap narrowed slightly in May.

Per Monday’s data, released by the stats bureau (NBS):

- Industrial value-added (IVA) grew 5.6% y/y in May, down from 6.7% growth the previous month

- Fixed asset investment (FAI) increased 3.4% y/y, down from 3.5% growth in April

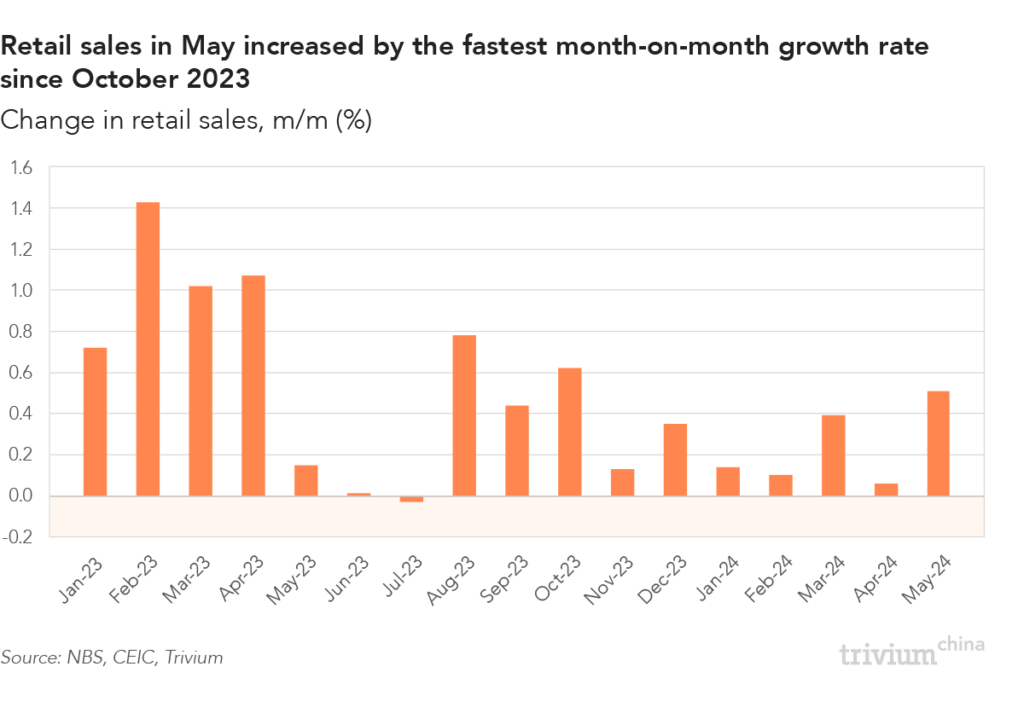

- Retail sales increased 3.7% y/y, up from April’s 2.3% growth

Business activity is slowing.

- On a seasonally adjusted month-on-month basis, IVA only grew by 0.3%, down from 1% m/m growth in April.

- FAI was down 0.04% m/m.

However, it’s not all doom and gloom for China’s supply side.

- Private sector IVA increased 5.9% y/y, outpacing the state sector for the second consecutive month.

- Non-property related FAI held up strongly, with investment in manufacturing and infrastructure growing approximately 9% and 8% y/y respectively, slightly down from the previous month.

On a month-on-month basis, retail sales increased by 0.51% – the fastest m/m growth rate since October 2023.

Get smart: Commentators will lament the slowdown in industrial output and FAI, but we think they’re missing the forest for the trees.

- China needs to reduce its reliance on supply-side growth drivers – this structural readjustment necessitates a slowdown in IVA and FAI growth, and a concurrent increase in household demand.

- May’s print suggests the first part of this equation is occurring – but we’re still waiting for the rebound in household demand.