China’s March exports fall sharply

China’s exports dropped sharply in March, but officials won't be panicking.

Per trade data released by the customs bureau Friday:

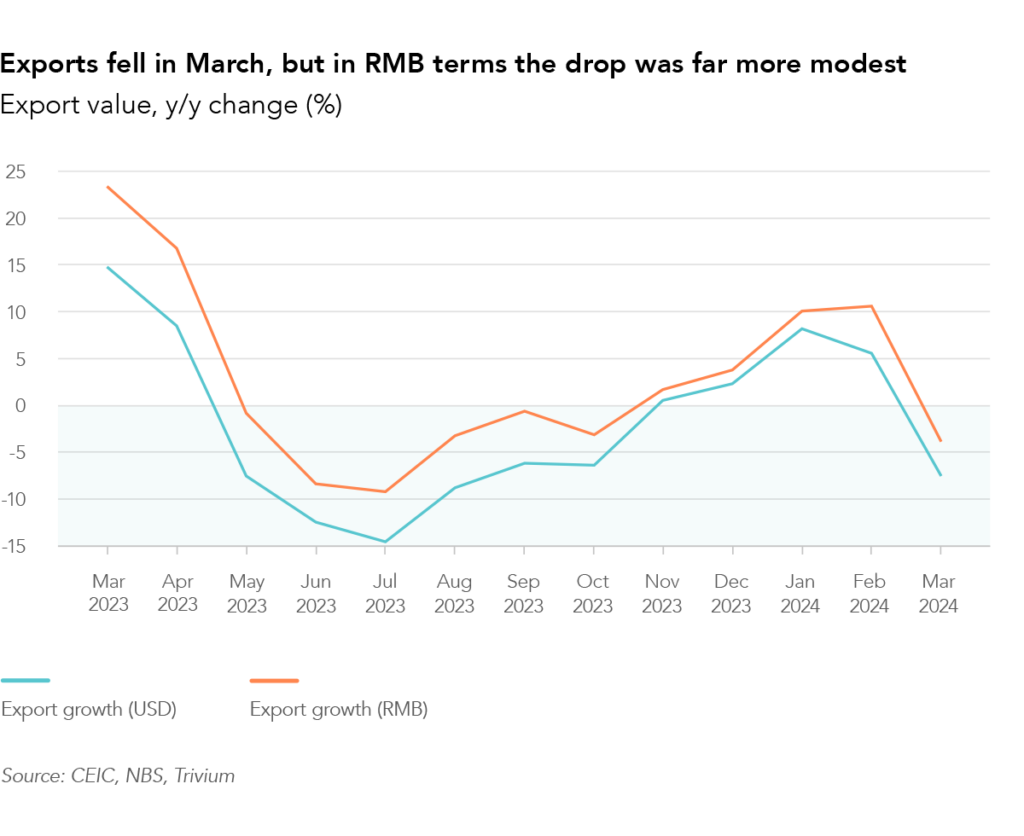

- Export value in USD terms shrunk 7.5% y/y in March, compared to 7.1% y/y growth across Jan-Feb.

- Import value fell 1.9% y/y, down from 3.5% y/y growth in the first two months of the year.

- The trade surplus was USD 58.6 billion, down from USD 77.1 billion in March 2023.

Exports to the US and EU are down 16% and 15% y/y, respectively.

However, the picture isn’t as bleak as the headline figures suggest.

- March 2024 had two fewer working days than March 2023, which impacted export shipments and exaggerated the y/y decline.

- Moreover, the sharp drop in USD terms is driven by RMB depreciation – in RMB terms, exports only fell 3.8% y/y, while imports grew 2.0% y/y.

Exports over the first quarter – which irons out seasonal effects and short-term currency fluctuations – are up 1.5% y/y in USD terms.

- While this is hardly something to shout about, it paints a far more positive picture than March’s year-on-year data.

Get smart: A weak currency, an ultra-competitive manufacturing industry, and base effects – exports shrunk 4.6% throughout 2023 – mean China's export growth will continue to rebound in 2024.

The bottom line: Despite the gloomy March data and rising trade tensions, exports will be an important growth driver this year.