Chinese consumption remains sluggish in early 2024

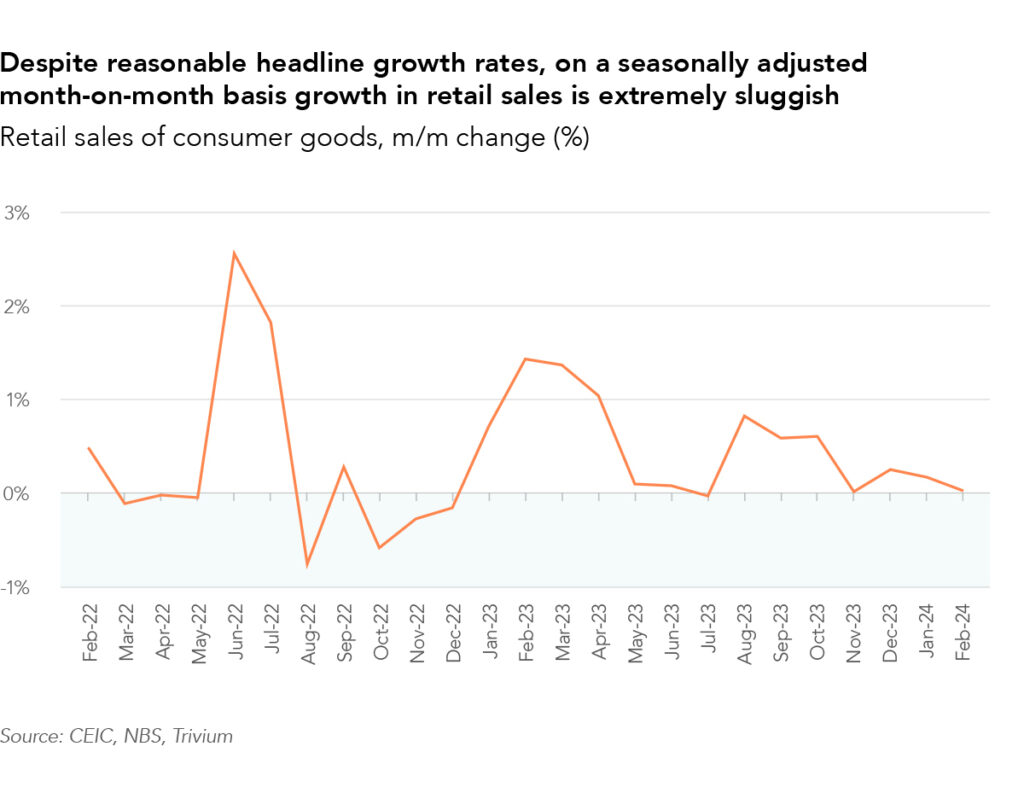

Retail sales in China have started off 2024 on a more sluggish note than the headline consumption figures suggest.

Per data released by the stats bureau (NBS) on Monday, retail sales grew 5.5% y/y in the combined Jan-Feb period.

However, on a seasonally-adjusted monthly basis, they grew just 0.17% and 0.03% m/m in January and February, respectively.

- This equates to an annualized growth rate of only 1.2%.

- For comparison, during the five years before the pandemic, the average annualized growth rate in the first two months of each year was 9%.

What's more, while sales of big-ticket items grew strongly, this was driven primarily by base effects. Throughout Jan-Feb 2024:

- Auto sales grew by 8.7% y/y, but had fallen 9.4% over the same period in 2023.

- Sales of household appliances grew by 5.7% y/y, after dropping 1.9% throughout Jan-Feb 2023.

- Construction and decoration materials grew by 2.1% y/y, after a 0.9% drop the year before.

Furniture sales were the one truly bright-ish spot, growing 4.6% y/y in Jan-Feb 2024, after increasing 5.2% y/y in the same period last year.

So people aren't buying much stuff – but in contrast, services sales are genuinely performing well.

- Retail sales of overall services and the catering sub-component both expanded by over 12% y/y in Jan-Feb, far outpacing growth in major goods sales.

Get smart: Policymakers’ promises to boost consumption are still falling short, a year later.

- And besides the State Council's recent push for consumer trade-ins of appliances and other durable goods, we don't see many new policy ideas.

The bottom line: Unless household consumers decide to pull out their wallets on their own, officials will struggle to engineer an economic upswing throughout this year.